Budgeting for Families is all about securing that bag and keeping your financial game strong. We’re diving into the importance of budgeting, creating a solid family budget, managing expenses like a boss, and even teaching the young ones the money moves. Get ready to level up your financial game, fam!

Importance of Budgeting for Families

Budgeting is essential for families as it helps them manage their finances effectively, plan for the future, and achieve their financial goals.

Financial Stability

Having a well-planned budget provides families with financial stability by ensuring that expenses are controlled, savings are prioritized, and emergencies are prepared for. It helps families avoid debt and live within their means.

Financial Goals

Budgeting allows families to set specific financial goals, such as saving for a new home, college education, retirement, or a family vacation. By tracking expenses and income, families can allocate funds towards reaching these goals and monitor their progress along the way.

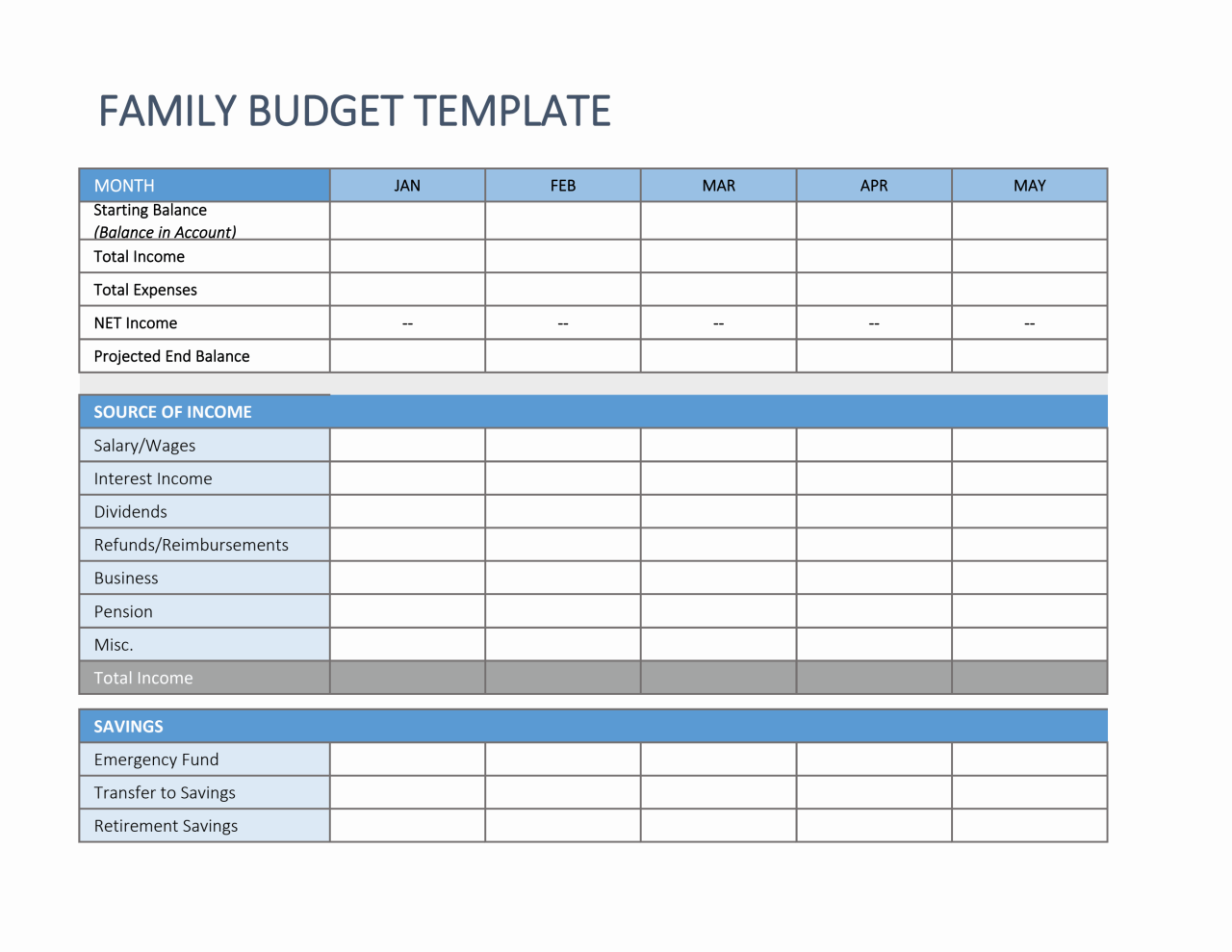

Creating a Family Budget

When it comes to creating a family budget, it’s essential to take a strategic approach to ensure financial stability and success. Follow these step-by-step guidelines to set up a budget that works for your family’s needs.

Step-by-Step Guide to Creating a Family Budget

- List all sources of income: Start by documenting all sources of income, including salaries, bonuses, side hustles, and any other money coming into the household.

- Track expenses: Keep track of all expenses for a month to understand where your money is going. Categorize expenses like housing, groceries, utilities, and entertainment.

- Set financial goals: Define short-term and long-term financial goals for your family, such as saving for a vacation, paying off debt, or building an emergency fund.

- Create a budget: Based on your income and expenses, create a budget that allocates specific amounts to each category. Ensure that your total expenses do not exceed your total income.

- Monitor and adjust: Regularly review your budget, track your spending, and make adjustments as needed to stay on track with your financial goals.

Setting Realistic Financial Goals within the Budget

- Start small: Begin by setting achievable financial goals that are realistic based on your current income and expenses.

- Prioritize: Identify the most important goals for your family and focus on achieving them first before moving on to others.

- Be specific: Clearly define your financial goals, including the amount you want to save or pay off and the timeframe in which you want to achieve them.

- Celebrate milestones: Acknowledge and celebrate when you reach small milestones on your way to achieving bigger financial goals.

Different Budgeting Methods Suitable for Families

- Traditional Budgeting: Involves assigning fixed amounts to different expense categories each month.

- Zero-Based Budgeting: Requires assigning every dollar of income to a specific expense or savings category, ensuring that income minus expenses equals zero.

- Envelope System: Cash-based budgeting method where you allocate cash to envelopes for different spending categories, helping you stick to your budget.

- 50/30/20 Budget: Allocates 50% of income to needs, 30% to wants, and 20% to savings and debt repayment.

Managing Family Expenses

When it comes to managing family expenses, it is crucial to have a clear understanding of where your money is going. By identifying common family expenses, implementing effective tracking and categorizing strategies, and finding ways to reduce unnecessary expenses, you can create a comprehensive family budget that helps you save money for the things that matter most.

Identify Common Family Expenses

- Housing costs, including rent or mortgage payments

- Utilities such as electricity, water, and heating

- Groceries and dining out

- Transportation expenses, like gas, car payments, and public transportation

- Healthcare costs, including insurance premiums and medical bills

- Childcare or education expenses

- Entertainment and leisure activities

- Debt payments, such as credit cards or loans

Strategies for Tracking and Categorizing Expenses Effectively, Budgeting for Families

- Use budgeting apps or spreadsheets to track expenses in real-time

- Assign categories to each expense (e.g., food, transportation, utilities) for easy organization

- Review your expenses regularly to identify any trends or areas where you can cut back

- Consider setting spending limits for each category to stay within your budget

Ways to Reduce Unnecessary Expenses and Save Money

- Avoid impulse purchases by creating a shopping list and sticking to it

- Comparison shop for big-ticket items to find the best deals

- Cook meals at home instead of dining out to save on food costs

- Cut back on subscription services or memberships that you do not regularly use

- Look for discounts or coupons when making purchases to save money

Teaching Kids about Budgeting

Teaching kids about budgeting is crucial for their financial literacy and future success. By involving children in the budgeting process, parents can instill good money habits from a young age and prepare them for financial independence.

Importance of Involving Children in Budgeting

- Teaching kids about budgeting helps them understand the value of money and the importance of making informed financial decisions.

- It empowers children to become responsible with their finances and develop good saving habits early on.

- By involving kids in budgeting, parents can create open communication about money matters and financial goals within the family.

Age-Appropriate Ways to Educate Kids about Budgeting

- For younger children, use piggy banks or savings jars to teach them the concept of saving money for specific goals.

- As kids grow older, introduce them to the idea of budgeting by giving them a small allowance and encouraging them to allocate money for different purposes like savings, spending, and giving.

- Use real-life examples and involve kids in family budget discussions to help them understand the practical aspects of managing finances.

Long-Term Benefits of Teaching Kids about Financial Responsibility

- Children who learn about budgeting early on are more likely to make sound financial decisions as adults and avoid debt traps.

- Teaching kids about financial responsibility can lead to increased financial confidence and independence in managing their money effectively.

- By instilling good money habits in children, parents can help them build a solid foundation for a secure financial future.