Budgeting for Families sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

Get ready to dive into the world of family budgeting where financial goals meet practical strategies for better money management.

Importance of Budgeting for Families

Budgeting is crucial for families as it helps them effectively manage their finances, plan for the future, and ensure financial stability. By creating and sticking to a budget, families can avoid unnecessary debt, save for emergencies, and work towards achieving their financial goals.

Benefits of Having a Well-Planned Family Budget, Budgeting for Families

- Allows families to track their income and expenses accurately.

- Helps in identifying areas where money can be saved or cut back.

- Ensures that bills and other financial obligations are paid on time.

- Provides a clear overview of financial goals and progress towards achieving them.

How Budgeting Can Help Families Achieve Their Financial Goals

- Setting specific financial goals such as saving for a vacation, buying a house, or funding a child’s education.

- Creating a budget that allocates funds towards these goals each month.

- Regularly reviewing and adjusting the budget to stay on track and make progress towards the goals.

- Celebrating milestones and accomplishments along the way to stay motivated.

Setting Up a Family Budget

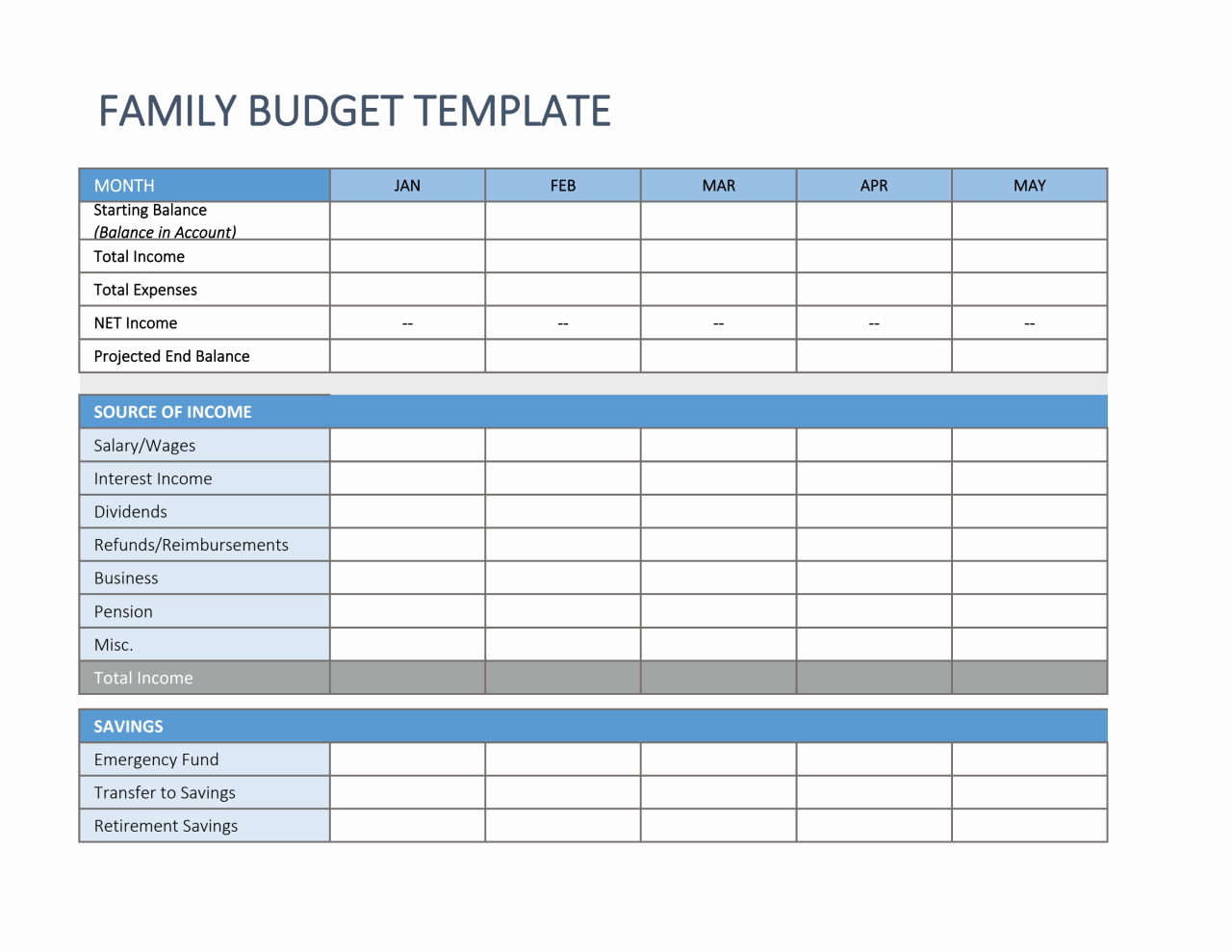

Creating a family budget is crucial for financial stability and achieving your financial goals. By following the right steps and using helpful tools, families can effectively manage their income and expenses.

Determining Income and Expenses

To set up a family budget, start by calculating your total monthly income. This includes all sources of income, such as salaries, bonuses, and any other earnings. Be sure to consider any irregular income like freelance work or side hustles.

Once you have a clear picture of your income, it’s time to track and categorize your expenses. List down all your monthly expenses, including fixed costs like rent/mortgage, utilities, insurance, and variable expenses like groceries, entertainment, and transportation. This will help you understand where your money is going and identify areas where you can cut back.

Budgeting Tools and Apps

There are several tools and apps available to help families with budgeting. Popular options include:

- Mint: A free app that allows you to track your spending, set budget goals, and receive alerts for upcoming bills.

- You Need A Budget (YNAB): This app focuses on zero-based budgeting, where every dollar has a job, helping you allocate your income wisely.

- GoodBudget: A digital envelope system that enables you to allocate funds for different categories and track your spending accordingly.

Using these tools can streamline the budgeting process and provide valuable insights into your financial habits, making it easier to stick to your budget and achieve your financial goals.

Managing Family Expenses

When it comes to managing family expenses, it’s essential to find ways to reduce costs and save money where you can. By implementing effective strategies, families can stay within budget and ensure financial stability.

Reducing Grocery Costs

One way to save money on groceries is by planning meals in advance and creating a shopping list to avoid impulse purchases. Look for sales and coupons, buy generic brands, and consider buying in bulk to save on costs. Additionally, cooking at home instead of dining out can significantly reduce expenses.

Saving on Utilities

To save money on utilities, consider making your home more energy-efficient by using programmable thermostats, sealing drafts, and turning off lights and appliances when not in use. Comparison shop for internet, cable, and phone services to find the best deals. Conserving water by fixing leaks and taking shorter showers can also lead to savings on utility bills.

Tracking Expenses and Staying Within Budget

Keep track of all expenses, including small purchases, to get a clear picture of where your money is going. Use budgeting apps or spreadsheets to monitor spending and identify areas where you can cut back. Set financial goals and prioritize essential expenses to ensure that you stay within your budget.

Teaching Kids About Budgeting

Teaching children about budgeting is crucial for their financial literacy and future success. By instilling budgeting concepts at a young age, kids can develop important money management skills that will benefit them throughout their lives.

Age-Appropriate Ways to Introduce Budgeting Concepts to Kids

- Start with the basics: Introduce the concept of earning, saving, and spending money to children in simple terms.

- Use real-life examples: Show kids how budgeting works in everyday situations, such as planning for a family outing or saving up for a toy.

- Make it fun: Create games or activities that involve budgeting, such as setting up a pretend store where kids can “buy” items with play money.

Involving Children in Budgeting to Develop Financial Literacy Skills

- Give them a budget: Allow children to have a small budget for discretionary spending, such as on toys or treats, and teach them to make choices within that budget.

- Encourage saving: Help kids set savings goals and track their progress, teaching them the importance of delayed gratification.

- Involve them in family budget discussions: Engage children in age-appropriate conversations about family finances, involving them in decisions when possible.